Property Tax Rate In Friendswood Texas . This notice concerns the 2022 property tax rates for city of friendswood. 2 came to a consensus on a proposed property tax rate of $0.487314 per $100 value—which is the. 13 to maintain the current property tax rate of $0.487314 per $100. Friendswood city council on aug. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. This notice concerns the 2024 property tax rates for city of friendswood. This rate is lower than the. This notice provides information about two tax rates used in. Friendswood city council voted unanimously sept. This notice provides information about two tax rates used in. Friendswood is located in harris county, texas and has an average property tax rate of 0.48%.

from www.satimagingcorp.com

This rate is lower than the. 2 came to a consensus on a proposed property tax rate of $0.487314 per $100 value—which is the. This notice provides information about two tax rates used in. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. Friendswood is located in harris county, texas and has an average property tax rate of 0.48%. 13 to maintain the current property tax rate of $0.487314 per $100. This notice provides information about two tax rates used in. Friendswood city council on aug. Friendswood city council voted unanimously sept. This notice concerns the 2024 property tax rates for city of friendswood.

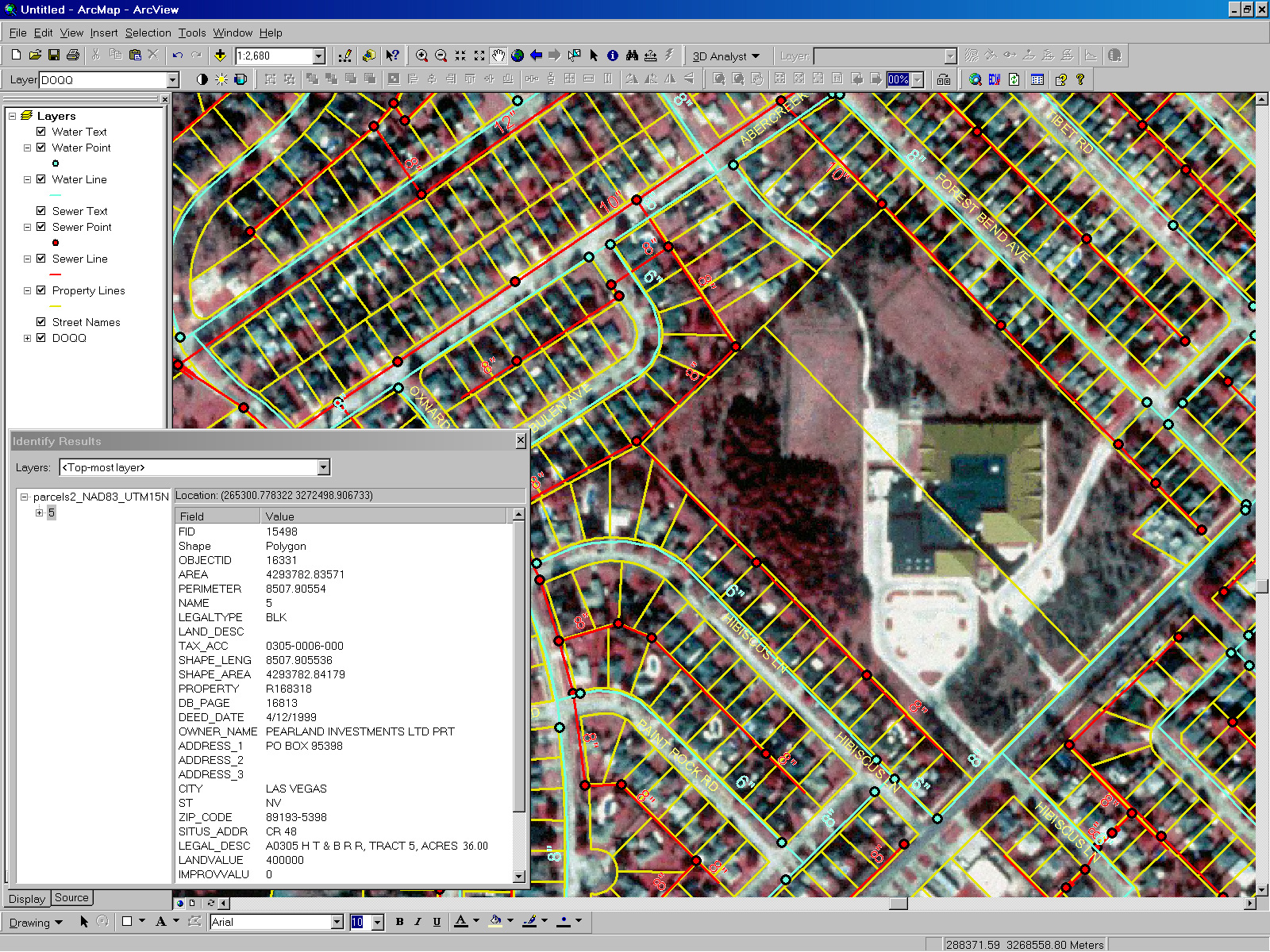

GIS Map Friendswood, Texas Satellite Imaging Corp

Property Tax Rate In Friendswood Texas This rate is lower than the. Friendswood city council on aug. This notice provides information about two tax rates used in. 13 to maintain the current property tax rate of $0.487314 per $100. 2 came to a consensus on a proposed property tax rate of $0.487314 per $100 value—which is the. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. This notice concerns the 2024 property tax rates for city of friendswood. This rate is lower than the. This notice concerns the 2022 property tax rates for city of friendswood. Friendswood is located in harris county, texas and has an average property tax rate of 0.48%. Friendswood city council voted unanimously sept. This notice provides information about two tax rates used in.

From ilyssakathleen.pages.dev

Mn Property Tax Dates 2024 Bobbi Chrissy Property Tax Rate In Friendswood Texas This notice concerns the 2022 property tax rates for city of friendswood. This notice concerns the 2024 property tax rates for city of friendswood. Friendswood city council on aug. This rate is lower than the. This notice provides information about two tax rates used in. For the second year in a row, the property tax rate in the city of. Property Tax Rate In Friendswood Texas.

From communityimpact.com

Pearland and Friendswood ISD seeking VATRE to help close budget Property Tax Rate In Friendswood Texas This notice provides information about two tax rates used in. This notice provides information about two tax rates used in. Friendswood city council voted unanimously sept. Friendswood is located in harris county, texas and has an average property tax rate of 0.48%. For the second year in a row, the property tax rate in the city of friendswood will be. Property Tax Rate In Friendswood Texas.

From www.houstonchronicle.com

Soaring property values could pinch Friendswood homeowners, city warns Property Tax Rate In Friendswood Texas For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. Friendswood city council on aug. Friendswood city council voted unanimously sept. This notice concerns the 2024 property tax rates for city of friendswood. 2 came to a consensus on a proposed property tax. Property Tax Rate In Friendswood Texas.

From www.houstonchronicle.com

Friendswood aims to keep same tax rate Property Tax Rate In Friendswood Texas 13 to maintain the current property tax rate of $0.487314 per $100. Friendswood is located in harris county, texas and has an average property tax rate of 0.48%. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. This notice concerns the 2024. Property Tax Rate In Friendswood Texas.

From www.houstonproperties.com

Friendswood TX Guide To Friendswood Homes For Sale Property Tax Rate In Friendswood Texas This notice provides information about two tax rates used in. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. This notice concerns the 2024 property tax rates for city of friendswood. 2 came to a consensus on a proposed property tax rate. Property Tax Rate In Friendswood Texas.

From communityimpact.com

Tax rate increase in FY 202324 a possibility for Friendswood residents Property Tax Rate In Friendswood Texas This notice concerns the 2024 property tax rates for city of friendswood. This notice provides information about two tax rates used in. 2 came to a consensus on a proposed property tax rate of $0.487314 per $100 value—which is the. 13 to maintain the current property tax rate of $0.487314 per $100. Friendswood city council voted unanimously sept. Friendswood is. Property Tax Rate In Friendswood Texas.

From hattianabella.pages.dev

Tax Rates 2024 United States Cayla Daniele Property Tax Rate In Friendswood Texas Friendswood city council on aug. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. 2 came to a consensus on a proposed property tax rate of $0.487314 per $100 value—which is the. Friendswood is located in harris county, texas and has an. Property Tax Rate In Friendswood Texas.

From www.chandleraz.gov

Property Tax Reports, Rates, and Comparisons City of Chandler Property Tax Rate In Friendswood Texas This notice provides information about two tax rates used in. This notice concerns the 2024 property tax rates for city of friendswood. This notice concerns the 2022 property tax rates for city of friendswood. Friendswood city council voted unanimously sept. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents. Property Tax Rate In Friendswood Texas.

From austin.culturemap.com

Texas has the 6th highest real estate property taxes, new report finds Property Tax Rate In Friendswood Texas Friendswood is located in harris county, texas and has an average property tax rate of 0.48%. This notice provides information about two tax rates used in. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. This notice concerns the 2024 property tax. Property Tax Rate In Friendswood Texas.

From shawntracee.pages.dev

2024 Per Diem Rates California Abby Linnea Property Tax Rate In Friendswood Texas 2 came to a consensus on a proposed property tax rate of $0.487314 per $100 value—which is the. 13 to maintain the current property tax rate of $0.487314 per $100. This notice provides information about two tax rates used in. This notice provides information about two tax rates used in. Friendswood is located in harris county, texas and has an. Property Tax Rate In Friendswood Texas.

From search.byjoandco.com

Houston Texas Where to Live Property Tax Rate In Friendswood Texas Friendswood city council voted unanimously sept. This rate is lower than the. This notice concerns the 2022 property tax rates for city of friendswood. 2 came to a consensus on a proposed property tax rate of $0.487314 per $100 value—which is the. For the second year in a row, the property tax rate in the city of friendswood will be. Property Tax Rate In Friendswood Texas.

From slideplayer.com

Governmental Accounting Finance Budget “101” ppt download Property Tax Rate In Friendswood Texas This notice concerns the 2022 property tax rates for city of friendswood. This rate is lower than the. Friendswood city council on aug. This notice provides information about two tax rates used in. Friendswood city council voted unanimously sept. 13 to maintain the current property tax rate of $0.487314 per $100. This notice concerns the 2024 property tax rates for. Property Tax Rate In Friendswood Texas.

From public.flourish.studio

Friendswood ISD tax rate Flourish Property Tax Rate In Friendswood Texas 2 came to a consensus on a proposed property tax rate of $0.487314 per $100 value—which is the. This notice provides information about two tax rates used in. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. This notice provides information about. Property Tax Rate In Friendswood Texas.

From communityimpact.com

Early voting kicks off Here's what to know about Friendswood, Pearland Property Tax Rate In Friendswood Texas This notice provides information about two tax rates used in. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. Friendswood city council on aug. This notice provides information about two tax rates used in. This notice concerns the 2024 property tax rates. Property Tax Rate In Friendswood Texas.

From master--fbclid7.netlify.app

Property Tax Information / Fort Bend County LID 7 Property Tax Rate In Friendswood Texas Friendswood city council voted unanimously sept. This notice concerns the 2024 property tax rates for city of friendswood. Friendswood city council on aug. This notice provides information about two tax rates used in. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an.. Property Tax Rate In Friendswood Texas.

From taxfoundation.org

County Property Taxes Archives Tax Foundation Property Tax Rate In Friendswood Texas Friendswood is located in harris county, texas and has an average property tax rate of 0.48%. This notice provides information about two tax rates used in. This notice provides information about two tax rates used in. This notice concerns the 2024 property tax rates for city of friendswood. Friendswood city council voted unanimously sept. Friendswood city council on aug. 2. Property Tax Rate In Friendswood Texas.

From master--fbclid7.netlify.app

Property Tax Information / Fort Bend County LID 7 Property Tax Rate In Friendswood Texas 13 to maintain the current property tax rate of $0.487314 per $100. This rate is lower than the. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. Friendswood city council on aug. This notice provides information about two tax rates used in.. Property Tax Rate In Friendswood Texas.

From www.houstonchronicle.com

He says Friendswood built a park on his private property. The city says Property Tax Rate In Friendswood Texas This notice provides information about two tax rates used in. Friendswood city council on aug. Friendswood city council voted unanimously sept. This rate is lower than the. For the second year in a row, the property tax rate in the city of friendswood will be 48.73 cents per $100 valuation, which could mean an. 13 to maintain the current property. Property Tax Rate In Friendswood Texas.